↧

Spinoff: 2007-2009 Club Music Appreciation

↧

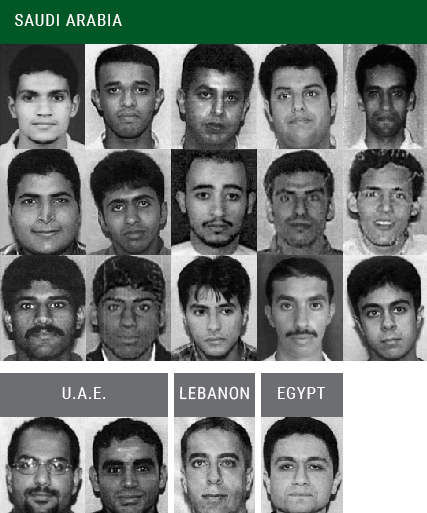

Adolf Trump’s Muslim Ban Excludes Countries He Has Business Ties With...

https://www.bloomberg.com/graphics/2017-trump-immigration-ban-conflict-of-interest/

![proxy.jpg?t=HBiWAWh0dHBzOi8vd3d3LmJsb29tYmVyZy5jb20vZ3JhcGhpY3MvMjAxNy10cnVtcC1pbW1pZ3JhdGlvbi1iYW4tY29uZmxpY3Qtb2YtaW50ZXJlc3QvaW1nLzIwMTctdHJ1bXAtaW1taWdyYXRpb24tYmFuLWNvbmZsaWN0LW9mLWludGVyZXN0X3R3aXR0ZXIucG5nP3Y9MRT2DhTmBxwUhAYUlAMAABYAEgA&s=vCiYn59ANhDfcNKqMjPdAgeLqaq1CQuWkBkEd1Jvg-o]()

![911.jpg]()

Trump’s Immigration Ban Excludes Countries With Business Ties

President Trump has signed an executive order that bans citizens from seven Muslim-majority countries in the Middle East from entering the United States for 90 days, according to the White House. His proposed list doesn’t include Muslim-majority countries where his Trump Organization has done business or pursued potential deals. Properties include golf courses in the United Arab Emirates and two luxury towers operating in Turkey.

↧

↧

The OTTB Wrestling News thread

Iiiight, let's try this again.

↧

Powerful Black Images

This thread is a thread of powerful/positive black images in celebration of black people that contribute to our history, culture, and our advancement as a people.

I ask that everybody who contributed to the original thread repost in this thread I'd like it to be as close to the original as possible.

![Africa-3.jpg&sa=X&ei=pfZDT4zxI-Tv0gHLvajdBw&ved=0CAkQ8wc4pAE&usg=AFQjCNHMKCfTR1_JA_-M8U_NZ7wUgneA4g]()

![tumblr_lrhkb1OWI11qfla0do1_500.jpg]()

![tumblr_lrfs9oV5LM1qfla0do1_500.jpg]()

![tumblr_lrbqsyTuZR1qfla0do1_400.jpg]()

I ask that everybody who contributed to the original thread repost in this thread I'd like it to be as close to the original as possible.

↧

First Picture of Quebec Mosque Gunman.... He's White!!!!

UNIVERSITY student Alexandre Bissonnette is the sole suspect in a mass shooting at a Quebec City mosque that killed six worshippers, a source said.

A second person being held in connection with the shooting at the Islamic Cultural Centre on Sunday night and is now considered a witness and not a suspect, the source added.

He was identified as Mohamed el Khadir and believed to be of Moroccan descent.

Bissonnette, 27, was arrested by Canadian police about 24km from the scene after reportedly calling police to say he was armed but ready to surrender.

US President Donald Trump called Canadian Prime Minister Justin Trudeau on Monday to express his condolences and offer assistance.

More than 50 people were at the mosque when the shooting erupted in the men’s section.

The six victims were reportedly aged between 35 and 65. A hospital spokeswoman said five were in critical condition and 12 others suffered minor injuries.

Sûreté du Quebec spokeswoman Christine Coulombe told TVA: “There is nothing to suggest that there are other suspects.”

Trudeau and Quebec Premier Philippe Couillard both characterised the attack as a terrorist act, which came amid heightened tensions worldwide over Trump’s travel ban on seven Muslim countries.

“We condemn this terrorist attack on Muslims in a centre of worship and refuge,” Trudeau said in a statement.

“It is heart-wrenching to see such senseless violence. Diversity is our strength, and religious tolerance is a value that we, as Canadians, hold dear. Muslim-Canadians are an important part of our national fabric, and these senseless acts have no place in our communities, cities and country.”

Canada is generally very welcoming toward immigrants and all religions, but the French-speaking province of Quebec has had a long-simmering debate about race and religious accommodation.

The previous separatist government of the province called for a ban on religious symbols such as the hijab in public institutions.

The mayor of Gatineau, Quebec, near Canada’s capital of Ottawa, said there would be an increased police presence at mosques around his city following the attack.

http://www.news.com.au/world/north-america/police-arrest-two-men-over-quebec-city-mosque-terror-attack/news-story/1c146a64c77f88396a58305da808cee0

↧

↧

Official Star Wars Cinematic Universe Thread: Now Showing "Rogue One"

Trynna fix the thread

↧

A$AP Rocky Producer James Laurence Dead At Age 27

Friendzone dropped their first mixtapes in the year 2010. They would then produce A$AP Rocky's hit single “Fashion Killa,” which was released in 2013 and featured on the rapper's debut album, Long. Live. A$AP. The production duo also made tracks for the likes of Yung Lean, Antwon, Main Attrakionz, and more.

The cause of Laurence's death is still unknown. Our condolences go out to his loved ones.

↧

Legends of Tomorrow (CW)

↧

Is this a case of just too much titty meat? And is there even such a thing?

↧

↧

The Flash (CW)

↧

Man slaps deal man at funeral

What would you do if somebody came into your friend's/relative's/loved ones funeral and did this??

.....smmfh.

![raw]()

.....smmfh.

↧

Cheap Seats What's on your Mind thread

Fuck that nigga Chi Town. Don't derail this thread with your constant bitching

What y'all niggas doing this weekend?

What y'all niggas doing this weekend?

↧

Cheyenne Fenwick

↧

↧

New Fire out of Brooklyn "Don't Run" by Casanova

↧

Jerry Rice's Chicken Helmet

Now this...this is coon shit

![l4s8dbigrfor.jpg]()

Unreal

Unreal

↧

When It Comes Time, Will They Ride For Us?

I'm over trippin off of how all these muthafuckas are riding for suspect Syrian refugees, illegals, and silly hoes, but I can't help to wonder why Trump sends the Feds to Chicago, or the next time one of these Neo Gestopo savages assaults or kills a black person, will they ride for us like they are for everybody else?

↧

The Official 2016-2017 NFL Season Thread.

↧

↧

Layla Monroe - Dumpster Truck Booty

My ppm niggas already know legend in the making

one of the thickest

![3391332_3_t.jpg]()

![28081_big.jpg]()

![074-640x426.jpg]()

![tumblr_myr9wrlc0E1rncmx8o5_1280.jpg]()

![laylamonroe.pick1.jpg]()

![39905a1054a8.jpeg]()

![tumblr_mviovzMSPq1ruz6zso1_250.gif]()

![tumblr_mwbeielDmF1r7how2o1_400.gif]()

![022-640x426.jpg]()

![assparade-ap12443-621110.jpg]()

![tumblr_mxolrv7VuO1s1gcc3o10_1280.jpg]()

![tumblr_mzo6miDZXo1snlkqdo1_1280.jpg]()

![tumblr_mzo6miDZXo1snlkqdo3_1280.jpg]()

![tumblr_mzo6jfssJ01snlkqdo3_1280.jpg]()

![tumblr_mzo6ih8XOG1snlkqdo1_1280.jpg]()

![tumblr_mvk9pxesqt1s777abo1_500.jpg]()

![Layla_Monroe0_tn.jpg]()

![laylamonroe.pick10.jpg]()

![56bc119b37d9.jpg]()

![laylamonroe2.pick1.jpg]()

![laylamonroe2.pick2.jpg]()

![Layla%20Monroe%20-%20Double%20up%20layla.jpg]()

![layla-monroe-black-pornstar_05-640x423.jpg]()

![76293.orignew.jpg]()

![Layla-Monroe-6.jpg]()

![aca5b1d78e.jpg]()

![Snapshot-2-2-4-2014-10-57-PM.png]()

![tumblr_n0ekquw7HQ1rctmefo1_400.gif]()

![tumblr_myn675mQgZ1snlkqdo1_250.gif]()

![tumblr_myn675mQgZ1snlkqdo3_250.gif]()

![tumblr_mwbeielDmF1r7how2o2_r2_400.gif]()

![tumblr_mwbeielDmF1r7how2o4_r1_400.gif]()

![tumblr_mw0dhgEg5d1rjp688o3_400.gif]()

![tumblr_mw9jrp0nJF1rjp688o9_400.gif]()

![tumblr_mw9jrp0nJF1rjp688o10_400.gif]()

![tumblr_myr9wrlc0E1rncmx8o8_1280.jpg]()

![tumblr_mwpxb323W01scqtivo3_400.gif]()

![BBW-Layla-Monroe-%28Amber-Love%29-2-%2AFull-Set%2A-101.jpg]()

![tumblr_mzvfysAI1a1rnc9mso1_400.gif]()

![tumblr_mvxpg7joNG1skmws5o4_400.gif]()

![tumblr_mw0dhgEg5d1rjp688o9_400.gif]()

![tumblr_mw0dhgEg5d1rjp688o8_400.gif]()

![tumblr_mw0dhgEg5d1rjp688o7_400.gif]()

one of the thickest

http://31.media.tumblr.com/b95c393309c65b8319637122dc779c13/tumblr_mwa2zrNbOy1ruz6zso1_250.gif

http://i59.fastpic.ru/big/2013/1114/9d/5ed70c50b44948d341c1b84a07cbcd9d.jpeg

http://x-images3.bangbros.com/bigtitsroundasses/shoots/btra12435/bangbros/big1.jpg

http://media.girlsnaked.net/wp-content/uploads/2014/01/big440.jpg

http://x-images3.bangbros.com/bigtitsroundasses/shoots/btra12435/bangbros/big3.jp

http://31.media.tumblr.com/b95c393309c65b8319637122dc779c13/tumblr_mwa2zrNbOy1ruz6zso1_250.gif

http://fap.to/images/51/202205085/black-ebony-porn/BBW-Layla-Monroe-(Amber-Love)-2-*Full-Set*-100.jpg

http://37.media.tumblr.com/8eabbe930167a1ef4cf9dad2cebf06a3/tumblr_mzo6z8FfVS1snlkqdo2_1280.jpg

http://31.media.tumblr.com/35f302c1326caf4ef09544f5dfa5e3bb/tumblr_mzo6oyv5w91snlkqdo1_1280.jpg

http://37.media.tumblr.com/93ea1c130826d5b604262468d218be47/tumblr_mzo67pgowo1snlkqdo1_400.gif

http://24.media.tumblr.com/295d9209b67f990fc55320c3c403e75f/tumblr_mzo67pgowo1snlkqdo2_400.gif

http://ist2-2.filesor.com/pimpandhost.com/5/9/0/8/59087/1/T/a/D/1TaDe/BaBr_Layla_Monr_m.jpg

http://i59.fastpic.ru/big/2013/1114/9d/5ed70c50b44948d341c1b84a07cbcd9d.jpeg

http://x-images3.bangbros.com/bigtitsroundasses/shoots/btra12435/bangbros/big1.jpg

http://media.girlsnaked.net/wp-content/uploads/2014/01/big440.jpg

http://x-images3.bangbros.com/bigtitsroundasses/shoots/btra12435/bangbros/big3.jp

http://31.media.tumblr.com/b95c393309c65b8319637122dc779c13/tumblr_mwa2zrNbOy1ruz6zso1_250.gif

http://fap.to/images/51/202205085/black-ebony-porn/BBW-Layla-Monroe-(Amber-Love)-2-*Full-Set*-100.jpg

http://37.media.tumblr.com/8eabbe930167a1ef4cf9dad2cebf06a3/tumblr_mzo6z8FfVS1snlkqdo2_1280.jpg

http://31.media.tumblr.com/35f302c1326caf4ef09544f5dfa5e3bb/tumblr_mzo6oyv5w91snlkqdo1_1280.jpg

http://37.media.tumblr.com/93ea1c130826d5b604262468d218be47/tumblr_mzo67pgowo1snlkqdo1_400.gif

http://24.media.tumblr.com/295d9209b67f990fc55320c3c403e75f/tumblr_mzo67pgowo1snlkqdo2_400.gif

http://ist2-2.filesor.com/pimpandhost.com/5/9/0/8/59087/1/T/a/D/1TaDe/BaBr_Layla_Monr_m.jpg

↧

The General Business Thread

Alright yall this is a spinoff from the Tax Implications thread that was started by @JonnyRoccIT . I made this thread to help out anybody who has general questions about getting started or going forward, legal matters in business, financing/banks/credit, how to find information, building websites, structure, taxation, business plans/proposals, investing, motivation - anything that has to do with running a business please ask the question here and me or @pralims will answer you promptly.

Anything that has to do with even supplying apps or anything for that matter that can help someone, anybody, somewhere do something easier or better will be greatly appreciated.

To kick things off I have put the topics in spoilers to make the O/P organized and easier to browse for mobile users.

Business Entity/Legal Structures

Sole Proprietorship

The simplest structure is the sole proprietorship, which usually involves just one individual who owns and operates the enterprise. If you intend to work alone, this structure may be the way to go. The tax aspects of a sole proprietorship are appealing because the expenses and your income from the business are included on your personal income tax return, Form 1040. Your profits and losses are recorded on a form called Schedule C, which is filed with your 1040. The "bottom-line amount" from Schedule C is then transferred to your personal tax return. This is especially attractive because business losses you suffer may offset the income you have earned from your other sources.

As a sole proprietor, you must also file a Schedule SE with Form 1040. You use Schedule SE to calculate how much self-employment tax you owe. In addition to paying annual self-employment taxes, you must make estimated tax payments if you expect to owe at least $1,000 in federal taxes for the year after deducting your withholding and credits, and your withholding will be less than the smaller of:

1) 90 percent of the tax to be shown on your current year tax return or

2) 100 percent of your previous year's tax liability.

The federal government permits you to pay estimated taxes in four equal amounts throughout the year on the 15th of April, June, September and January. With a sole proprietorship, your business earnings are taxed only once, unlike other business structures. Another big plus is that you will have complete control over your business--you make all the decisions. There are a few disadvantages to consider, however. Selecting the sole proprietorship business structure means you are personally responsible for your company's liabilities. As a result, you are placing your assets at risk, and they could be seized to satisfy a business debt or a legal claim filed against you.Raising money for a sole proprietorship can also be difficult. Banks and other financing sources may be reluctant to make business loans to sole proprietorships. In most cases, you will have to depend on your financing sources, such as savings,

home equity or family loans.

Partnership

If your business will be owned and operated by several individuals, you'll want to take a look at structuring your business as a partnership. Partnerships come in two varieties: general partnerships and limited partnerships. In a general partnership, the partners manage the company and assume responsibility for the partnership's debts and other obligations. A limited partnership has both general and limited partners. The general partners own and operate the business and assume liability for the partnership, while the limited partners serve as investors only; they have no control over the company and are not subject to the same liabilities as the general partners.

Unless you expect to have many passive investors, limited partnerships are generally not the best choice for a new business because of all the required filings and administrative complexities. If you have two or more partners who want to be actively involved, a general partnership would be much easier to form.

One of the major advantages of a partnership is the tax treatment it enjoys. A partnership does not pay tax on its income but "passes through" any profits or losses to the individual partners. At tax time, the partnership must file a tax return (Form 1065) that reports its income and loss to the IRS. In addition, each partner reports his or her share of income and loss on Schedule K-1 of Form 1065.

Personal liability is a major concern if you use a general partnership to structure your business. Like sole proprietors, general partners are personally liable for the partnership's obligations and debts. Each general partner can act on behalf of the partnership, take out loans and make decisions that will affect and be binding on all the partners (if the partnership agreement permits). Keep in mind that partnerships are also more expensive to establish than sole proprietorships because they require more legal and accounting services.

The other portion is in the next post

As for what state is best to incorporate in, it really depends on what type of business you're trying to build. Please PM me and I may be able to assist you.

Motivation

For motivation give these books a read:

Rich Dad, Poor Dad by Robert Kiyosaki

![51M2U9IfmTL.jpg]()

Think & Grow Rich by Napoleon Hill

![Think-and-Grow-Rich.jpg]()

@pralims

@traestar

@black caesar

@MarcusGarvey

@kontakz

@BigBallsNoWorries

@YunnSanco

@KingSimba

Feel free to post if yall can contribute, anything is plenty.

Anything that has to do with even supplying apps or anything for that matter that can help someone, anybody, somewhere do something easier or better will be greatly appreciated.

To kick things off I have put the topics in spoilers to make the O/P organized and easier to browse for mobile users.

Business Entity/Legal Structures

Sole Proprietorship

The simplest structure is the sole proprietorship, which usually involves just one individual who owns and operates the enterprise. If you intend to work alone, this structure may be the way to go. The tax aspects of a sole proprietorship are appealing because the expenses and your income from the business are included on your personal income tax return, Form 1040. Your profits and losses are recorded on a form called Schedule C, which is filed with your 1040. The "bottom-line amount" from Schedule C is then transferred to your personal tax return. This is especially attractive because business losses you suffer may offset the income you have earned from your other sources.

As a sole proprietor, you must also file a Schedule SE with Form 1040. You use Schedule SE to calculate how much self-employment tax you owe. In addition to paying annual self-employment taxes, you must make estimated tax payments if you expect to owe at least $1,000 in federal taxes for the year after deducting your withholding and credits, and your withholding will be less than the smaller of:

1) 90 percent of the tax to be shown on your current year tax return or

2) 100 percent of your previous year's tax liability.

The federal government permits you to pay estimated taxes in four equal amounts throughout the year on the 15th of April, June, September and January. With a sole proprietorship, your business earnings are taxed only once, unlike other business structures. Another big plus is that you will have complete control over your business--you make all the decisions. There are a few disadvantages to consider, however. Selecting the sole proprietorship business structure means you are personally responsible for your company's liabilities. As a result, you are placing your assets at risk, and they could be seized to satisfy a business debt or a legal claim filed against you.Raising money for a sole proprietorship can also be difficult. Banks and other financing sources may be reluctant to make business loans to sole proprietorships. In most cases, you will have to depend on your financing sources, such as savings,

home equity or family loans.

Partnership

If your business will be owned and operated by several individuals, you'll want to take a look at structuring your business as a partnership. Partnerships come in two varieties: general partnerships and limited partnerships. In a general partnership, the partners manage the company and assume responsibility for the partnership's debts and other obligations. A limited partnership has both general and limited partners. The general partners own and operate the business and assume liability for the partnership, while the limited partners serve as investors only; they have no control over the company and are not subject to the same liabilities as the general partners.

Unless you expect to have many passive investors, limited partnerships are generally not the best choice for a new business because of all the required filings and administrative complexities. If you have two or more partners who want to be actively involved, a general partnership would be much easier to form.

One of the major advantages of a partnership is the tax treatment it enjoys. A partnership does not pay tax on its income but "passes through" any profits or losses to the individual partners. At tax time, the partnership must file a tax return (Form 1065) that reports its income and loss to the IRS. In addition, each partner reports his or her share of income and loss on Schedule K-1 of Form 1065.

Personal liability is a major concern if you use a general partnership to structure your business. Like sole proprietors, general partners are personally liable for the partnership's obligations and debts. Each general partner can act on behalf of the partnership, take out loans and make decisions that will affect and be binding on all the partners (if the partnership agreement permits). Keep in mind that partnerships are also more expensive to establish than sole proprietorships because they require more legal and accounting services.

The other portion is in the next post

As for what state is best to incorporate in, it really depends on what type of business you're trying to build. Please PM me and I may be able to assist you.

Motivation

For motivation give these books a read:

Rich Dad, Poor Dad by Robert Kiyosaki

Think & Grow Rich by Napoleon Hill

@pralims

@traestar

@black caesar

@MarcusGarvey

@kontakz

@BigBallsNoWorries

@YunnSanco

@KingSimba

Feel free to post if yall can contribute, anything is plenty.

↧

Who's a bigger star Trae or Z-Ro?

Who is a bigger rap star to you Trae or Z-Ro?

↧